What a difference a year makes for timber industry

SANDPOINT - What a difference a year makes.

From the uncertainty caused by the start of the COVID-19 pandemic, lumber prices have taken off as homeowners move to areas they've only dreamt about before and have taken advantage of lower interests to build their dream homes.

Timber prices have skyrocketed. In April, the Random Lengths Framing Lumber Composite Price index peaked at an all-time high of $1,044/Mbf (thousand board feet) compared to $400/Mbf roughly a year earlier in March 2020, Mike Wolcott of Inland Forest Management Inc.'s website in its "Timber Talk" for April.

"In other words, it’s a classic ECON 101 demonstration of low supply in a climate of high demand driving prices up (and up, and up)," Wolcott said. "Speculation is that these pressures will not soon be relieved and lumber prices [would] continue at historic highs into the summer."

Wolcott said there are several reasons for the higher costs, not the least of which is good old-fashioned supply and demand.

On the heels of the pandemic, lumber inventories dramatically dropped due to sawmill shutdowns coupled with staffing shortages at the mills that remained opened meant it was impossible to match lumber supply to the demand. On the flip side, homeowners — many stuck at home due to the pandemic and work-from-home regulations — turned to renovation and home repair projects to keep busy.

Added to the mix and contributing to costs and supply and demand issues were low interest rate financing fueled an unprecedented uptick in housing starts, Wolcott said.

"Frustratingly for timber owners, log prices have not tracked with these inflated lumber prices," he said on the website. "Again, supply and demand play a key role. In many areas of the country, including the Inland Northwest, there are more logs available than sawmills can process, so there’s little incentive to raise log prices since that action would just increase log deliveries and further flood already overflowing log yards."

Looking forward, Wolcott said timber owners need to "consider the long game" and look toward the future. A healthy sawmill industry has capital to invest in increased efficiency and equipment upgrades. The steps are expected to pay dividends for the entire industry headed into the future, he said in the newsletter.

"[O]ver the last few months, log prices have moved upward in the Inland Northwest at a modest pace, which has increased profit margins for timber owners," he said. "Prudent landowners should focus on the general health and vigor of his/her forest and take advantage of this trending upward market when appropriate."

Before the Great Recession of 2007-'08, the housing industry averaged 2 million new housing starts the year before, dropping to as low as 1.4 million starts during the economic crisis. While things improved in 2020, things weren't back to previous levels when the pandemic hit. Housing starts dropped in half - to about 800,000 when adjusted for seasonal variations in April.

Fear over the uncertainty caused by the pandemic had people putting projects on hold as they waited for things to settle down, Idaho Forest Group officials said last year at the start of the pandemic.

Based in Coeur d'Alene, IFG operates facilities throughout the region, including five sawmills in Idaho and another in Montana, and a finger-joint facility in Athol. The family-owned company is one of the country's largest lumber producers with capacity for more than a billion board feet per year selling both locally and internationally.

Timber and logging were deemed essential industries, which meant mills were able to stay open and loggers remained in the woods and continue to work - no small thing given the industry's financial footprint.

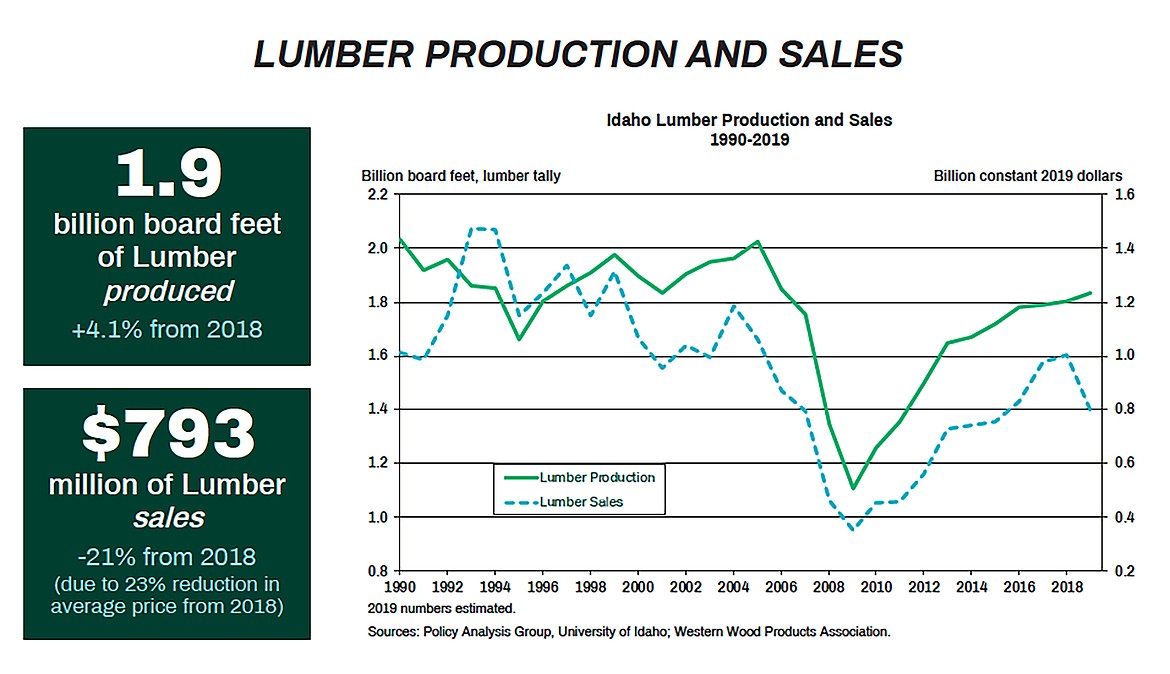

In the region, Associated Logging Contractors of Idaho officials estimate the forest products industry directly employs more than 16,400 people with an estimated 14,800 people holding down support jobs connected to the industry. Average annual wages for logging and hauling jobs range from $28,950 to $63,840. Of the products sold, 90 percent were exported out of Idaho and added $793 million in sales and $2.2 billion to the state's gross domestic product.

When the pandemic hit, the forest products industry saw prices plummet - down about 40 percent, IFG's Tom Schultz, Vice President of resource and government affairs, said.

While timber production was curtailed due to that uncertainty, people required to stay at home began looking for things to do, with home repairs and renovations among activities topping the list of activities. Home improvement stores such as Lowe's, The Home Depot, Ziggy's, and Menards saw huge demand with lines in the spring sometimes winding around the store and waits to get inside as long as an hour and a half. That demand saw Lowe's and The Home Depot record some of their strongest quarterly sales growth in several decades.

However, the supply wasn't always there because many had curtailed production in the early days of the pandemic. That lead to higher prices as demand outweighed the limited product that was available.

"There was just significant demand, and the supply wasn't available as robustly as maybe what people desired and you have this imbalance," Schultz said at the time. "So what happens when you have high demand and lack of supply, prices go up ... we saw an increase in price for lumber and other products up as much as they had dropped."

In addition to supply and demand issues, another piece of the puzzle is availability of logs. Typically with the industrial landowner base, supply comes at a consistent pace. On the non-industrial side, the market is very price sensitive so that as the price increases, more private landowners - those with maybe 10, 50 or 100 acres - opt to take action.

The timber industry remains a popular one with strong interest in programs such as those offered at the University of Idaho's College of Natural Resources. While enrollment is down at the university overall, the college has seen increased enrollment.

Within the forest products industry, there are different skill sets for those interested in forestry, working in a mill, or any of the other fields that fall within the industry as a whole.

"What we see happening, though, on the mill side, as we have more and more innovation and more technology, we're going to require people who have a greater level of skills," Schultz said in 2020. "So [we'll need] more engineers, more technicians, we actually see that as pretty darn exciting as we go into the future."

And as technology continues to evolve and use of robotics and technology continues to increase, the timber products industry is going to require more of a skilled workforce than maybe it has historically.

It's not uncommon for workers in one area of the forest products industry, such as a mill, to seek certification to boost their skills while still a part of the workforce. Apprenticeship programs also are popular - whether the youth are still in high school or have recently graduated.

While interest remains high for jobs in much of the industry, there is a national shortage for truck drivers.

The forest products industry, especially in the Intermountain region in particular - eastern Washington, North Idaho and western Montana - is strong.

The industry, as always, remains focused on sustainability of the resource, similar to farmers nurturing their crops for the best harvest, timber industry officials say.

"It's the same thing with forestry, if you don't take care of the land and reforest and fertilize if necessary, you're not going to have a crop in the future" Schultz said last year. "So sustainability is key to us and we're producing a renewable resource. As people are concerned about climate change or carbon issues or forest fires or catastrophic wildfires, one of the best things we can do is manage our forests sustainably."

The industry works collaboratively with everyone from environmentalists and conservationists to county commissioners and the public, Schultz said. Idaho Forest Group is deeply committed and works to ensure all voices are heard and that it supports agencies trying to manage their own land base.

"I think that's a key piece, not to lose in all of this," Schultz said. "This industry works within a renewable resource and we are for sustainability, whether those lands are private lands, whether those lands are public lands."