Williams accused of not paying taxes

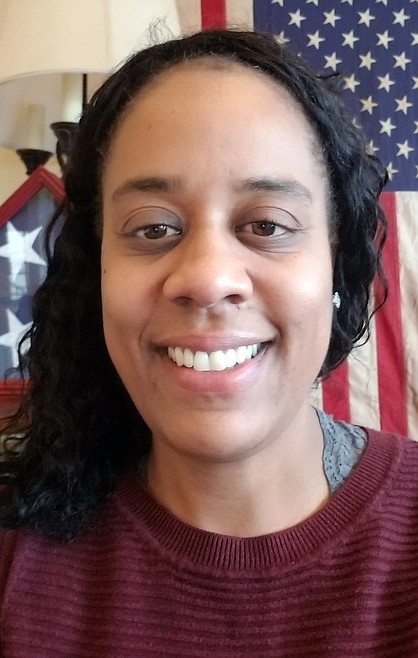

SANDPOINT — Bonner County Commissioner Asia Williams came under fire recently when public commenters accused her of failing to pay her taxes.

During the Nov. 14 meeting, one public commenter got up and asked the board of county commissioners a few questions. One of those questions was if each of them paid their taxes. While commissioners Luke Omodt and Steve Bradshaw answered yes immediately, Williams hesitated and said she wasn’t sure what the point of the question was.

“It’s just a question,” the commenter said. “Your silence can be your answer, apparently.”

Williams eventually said yes, she does pay her taxes. However, the next public commenter to speak claimed that was untrue. From a post that Williams made Aug. 14 on Facebook, the public commenter read, “Transparency is for those who carry out public duties and exercise public power. Privacy is for everyone else.”

The commenter, referring to Williams as the county’s “transparency champion,” said the District 2 commissioner currently has three tax liens issued by the lien department for the Idaho State Tax Commission, dating as far back as December 2022 and totaling roughly $6,000.

“We pay each one of you just shy of $100,000 a year,” the commenter said. “And I feel like if you are able to manage a budget of that amount of money, you should pay your taxes.”

Williams responded to these claims, saying that she does pay her taxes and that liens are a common document to receive in the mail.

“Paying taxes is what I have done,” she said. “If you ever file your IRS forms and you owe, you get a lien. It’s automatic. So having a lien doesn’t mean I’m not paying my taxes.”

However, according to the Internal Revenue Service website, tax liens are not sent out as soon as it is deemed that an individual owes money on their taxes. Liens are only sent when the individual fails to pay the amount due on time.

“A federal tax lien exists after the IRS puts your balance due on the books … sends you a bill that explains how much you owe … and you neglect or refuse to fully pay the debt in time,” the website said.

Williams said Idaho offers payment plans for those who need more time to pay their taxes and that is what she is doing. Once her stepson moved out, she said it changed what deductions she qualified for, and she is working to pay the remaining balance due to the IRS.

“I have back taxes; I’m paying them,” she said. “My answer is valid.”