Medicare Part D changes may cause higher premiums, fewer market options

Changes to Medicare Part D prescription drug coverage are on the way.

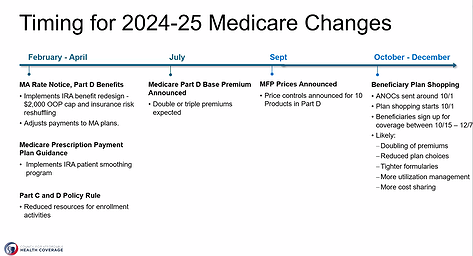

Under the Inflation Reduction Act, new policies were rolled out this year and more changes will be spread out over the next two years.

Some of the changes include annual out-of-pocket costs will be capped at $2,000 for people with Medicare Part D in 2025 and the government will set prices in Part D program for the most-used drugs in Medicare in 2026.

Patient smoothing for prescription medications went into effect earlier this year and allows Part D patients to spread costs over the year.

Some of the past impacts from the Inflation Reduction Act on prescription drugs may be more familiar, such as people with Medicare Part D coverage paying no more than $35/month for insulin. As another part of the law, recommended vaccines are available at no cost for people with Medicare prescription drug coverage.

The Council for Affordable Health Coverage noted the Inflation Reduction Act places more insurance risk on health plans and less on beneficiaries.

During a webinar Thursday though Rural Minds and National Grange, Joel White of the Council for Affordable Health Coverage presented some of the pros and cons of the changes on the complicated topic.

“This law is causing a lot of disruption,” White said.

He considers the security and overall lower prices for patients to be the biggest assets provided through Medicare Part D, but is concerned about the changes to the Part D market as new provisions go into place over the next two years.

White was involved in the crafting of the 2002 Trade Act, which created health care tax credits, as well as the 2003 law firming up the Medicare prescription drug benefit and Health Savings Accounts and the 2006 Tax Reform and Health Care Act updating Medicare payment policies.

“One of the things we thought about when we created Part D was, we didn’t want the government involved in these pricing decisions. The plans were negotiating with the drug manufacturers, but they were no longer passing those prices to the patients,” White said.

Now, with the Inflation Reduction Act, politicians now will set the prices.

Concerns stem from a 21.5% premium increase projected for October of this year and a smaller pool of Part D plan options for patients to choose from.

“The challenge we see is more and more plans may choose to not participate in Part D,” White said.

So far, from 2023 into this year, there has been a drop of about 100 standalone plans available in the Part D marketplace.

Creating a robust market was part of the framework of how Medicare functions, but without modifications, White is concerned about problems affecting patients in the system.

“It's getting to be a much more expensive market with fewer choices,” White said.

Prescription drug assistance in Idaho

Idaho Rx Card offers savings of up to 80% for prescriptions for low-income patients.

The program has been in place since 2011 is more information is available at (208) 297-3238.

The Medicare Part D timeline 2024-2026

The Medicare Part D timeline 2024-2026